Ways to Give

Your gift to Broadway House changes lives.

Broadway House for Continuing Care provides many flexible options for you to structure your gifts, while supporting our mission and providing important donor benefits.

Annual Fund—Cash Donations

Most donors choose to make an outright gift to the Annual Fund, either online or by mail.

Checks and money orders payable to Broadway House for Continuing Care may be mailed to:

Broadway House for Continuing Care

Att: Development Office

298 Broadway

Newark, NJ 07104

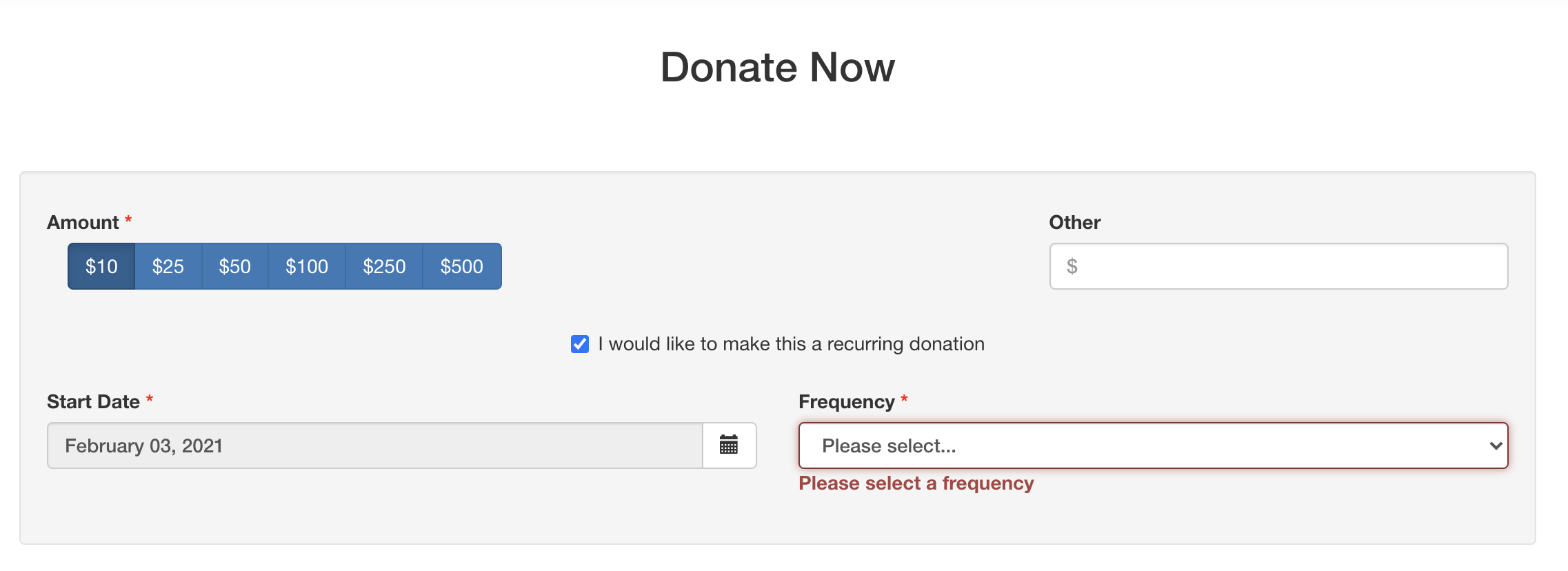

Recurring Gifts

Predictable revenue is important to any organization’s long-term planning. Many of our donors choose to set up a recurring gift to Broadway House, providing a dependable flow of contributions that fund our vision and make a bigger impact. Recurring gifts can be made using a credit card on a weekly, monthly, quarterly or annual basis. An equal amount is charged each period, allowing donors to maximize their investment over time.

To make your recurring gift, simply click the recurring gift box and choose start date and frequency on our online form.

Matching Gifts

Double the power of your gift to Broadway House with a matching gift from you, or your spouse’s, employer. Many employers sponsor matching gift programs. Contact your Human Resources Department to find out if your company will match employees’ charitable contributions.

You may need the following information to complete your matching gift paperwork:

Broadway House for Continuing Care

298 Broadway

Newark, NJ 07104

- Broadway House Federal Tax Identification Number: 22-2903536

- Program Destination: General Operations

- Phone: 973.268.9797

- Fax: 973.268.1314

Donor Advised Funds (DAF)

A donor-advised fund (DAF) is a type of giving program that allows you to combine the most favorable tax benefits with the flexibility to easily support your favorite charities. An increasingly popular charitable vehicle, DAFs are an excellent way to simplify your charitable giving, advance your strategic philanthropic goals, and establish a meaningful family legacy. For information about establishing a DAF and designating Broadway House for Continuing Care as a beneficiary, call 973.268.9797 Ext. 1041 or email papcial1@uhnj.org

Stocks & Securities

Gifts of appreciated stocks and securities can be the best way to support Broadway House for Continuing Care, particularly if they have grown in value. Donating appreciated securities allows you to avoid capital gains taxes while earning a charitable deduction on the full value of the securities.

To make a gift of securities to Broadway House for Continuing Care write a letter or email your broker stating your intention. You must provide the following information:

- Name of stock to be transferred (call letters are helpful)

- Number of shares to be transferred

- Your account number (from your broker or financial representative

Our name and address:

Broadway House for Continuing Care

298 Broadway

Newark, NJ 07104

Our broker’s name, address and telephone number:

John Ward

TD Bank

255 Nassau Street, 1st Floor

Princeton, NJ 08540

609.528.6402

Our Brokerage Account #: QYY020504

Our Tax ID #: 22-2903536

IRA Rollover (Qualified Charitable Distribution)

If you are 70½ years or older, consider a gift directly from your IRA. The IRA Charitable Rollover allows direct transfers from your IRA to Broadway House for Continuing Care without reporting the distribution as adjusted gross income on your tax return.

The Qualified Charitable Distribution is an excellent way to show your support for Broadway House and receive tax benefits in return. Whether you are planning your required minimum distribution (RMD) or not, consider using your IRA account to make the most of your charitable giving. You receive a tax benefit even if you take the standard deduction.

It is important to consider your tax situation before deciding whether to make a charitable contribution from your IRA. Be sure to share this gift plan with your financial advisor or tax professional.

To Qualify

- You must be 70½ or older at the time of the gift.

- Distributions must be made directly from a traditional IRA account by your IRA administrator.

- Gifts must be outright, meaning they go directly to Broadway House for Continuing Care. Distributions to donor-advised funds or life-income arrangements such as charitable remainder trusts and charitable gift annuities do not qualify.

- Gifts from 401k, 403b, SEP and other plans do not qualify. Ask your financial advisor if it would make sense for you to create a traditional IRA account so you can benefit from an IRA Qualified Charitable Distribution.

Tax Benefits

- IRA Qualified Charitable Distributions are excluded as gross income for federal income tax purposes on your IRS Form 1040.

- The gift counts toward your required minimum distribution for the year in which you made the gift.

- You could avoid a higher tax bracket that might otherwise result from adding an RMD to your income.

Real Estate

When you make a gift of property to Broadway House for Continuing Care, you can claim an income-tax charitable deduction based on the full market value of the gift, avoid capital gains taxes, and eliminate certain costs associated with the transfer of real property. Gifts of real estate can also provide you with long-term income.

Gifts-in-Kind

You may wish to give Broadway House for Continuing Care a non-monetary gift. Broadway House receives a wide variety of such gifts, including new electronic devices, automobiles, office equipment, and other items.

Planned Giving

Planned giving provides opportunities for you to support Broadway House for Continuing Care while receiving tax and other financial benefits. Some options will provide you with income payments and a charitable donation. Consult with your tax advisor to determine which is right for you:

Bequests

A bequest, made by allocating a gift to Broadway House in your will, is a simple way to support our organization and possibly reduce the taxes owed on your estate.

Charitable Gift Annuities

A charitable gift annuity allows donors to transfer assets to Broadway House and designate a beneficiary (you, your spouse, or another beneficiary) to receive a fixed income for the remainder of your lifetime(s). Donated assets can be in the form of cash or securities. The minimum amount is $10,000.

Charitable Lead Trusts

Broadway House receives fixed payments for the term of the trust, with the donor or beneficiaries receiving the remainder.

Charitable Remainder Trusts

The donor receives regular payments from the trust, while Broadway House for Continuing Care receives the remainder of the trust at the end of the designated time period. Charitable remainder trusts can help you to avoid capital gains taxes, as well as reduce income and estate taxes.

Life Insurance

A donation of life insurance can provide Broadway House for Continuing Care with future income and provides no tax liability upon the donor’s death.

Real Estate

A gift of real estate to Broadway House for Continuing Care supports our residents, while providing you with a charitable income tax deduction, and possibly, a way to avoid capital gains tax. Your estate may also benefit, since the value of the real estate is removed from your taxable estate. There are several ways to make a real estate gift to Broadway House for Continuing Care:

- Bequeathing the property

- Giving the property outright

- Transferring the property into a charitable remainder trust

- Establishing a retained life estate, which enables you to gift the property to Broadway House, but reserve its use for your lifetime or that of another beneficiary.

Retirement Plan Assets

Making Broadway House for Continuing Care the beneficiary of your retirement account can potentially reduce the tax burden on your other beneficiaries.

Endowed Funds

Establishing an endowed fund is a great way to support Broadway House for Continuing Care and leave a legacy. You can elect to establish an endowed fund for Broadway House through the Community Foundation of New Jersey that provides support for our organization in perpetuity or for a fixed period of time. During that fixed period, the gift amount and all earnings are expended in accordance with the terms of the endowment so that no funds remain.

For further information, contact Lisa Papciak, Director of Marketing and Development, at 973.268.9797, ext. 1041 or papcial1@uhnj.org

Another Way to Give

Amazon donates 0.5% of the price of your eligible AmazonSmile purchases to the charitable organization of your choice.

AmazonSmile is the same Amazon you know. Same products, same prices, same service.

Support Broadway House for Continuing Care by starting your shopping at smile.amazon.com